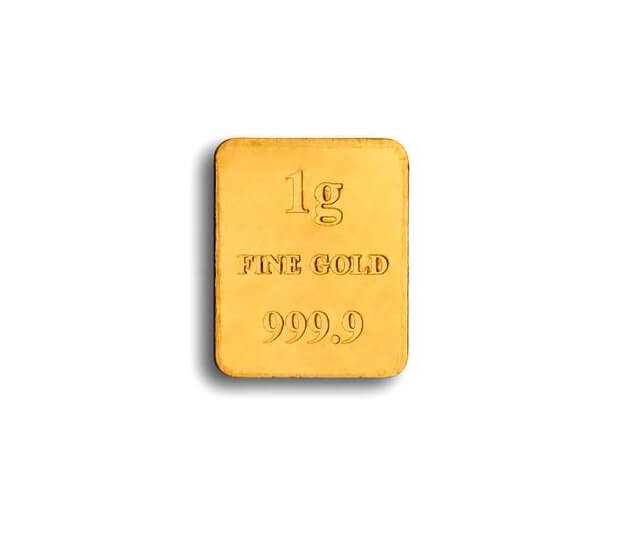

Gold appears set to remain well-supported due to historically low interest rates, quantitative easing, and fiscal and political concerns, despite optimism that the U.S. economy will recover quicker than expected.

Gold slipped as the dollar rose on September 17 after the Federal Reserve (U.S. central bank) signalled it expected the recovery of the world’s largest economy to accelerate, with joblessness falling faster than its forecast in June.

When the dollar rises, dollar-denominated gold becomes more expensive in other currencies.

Gold was off 0.85 percent at $1,944.17 per ounce on September 17.

In a report published on September 15, commodity analysts at CIBC published their gold and silver forecasts for the rest of the year into 2021.

The analysts said that they see gold prices averaging the third quarter around $1,925 an ounce. The average goes up to $2,000 for the fourth quarter.

Looking ahead, CIBC sees gold prices averaging $2,300 an ounce in 2021, $2,200 an ounce in 2022, $2,100 in 2023 and $2,000 an ounce in 2024.

The outlook for continued low real interest rates, increasing government debt burdens coupled with geopolitical uncertainty arising from the upcoming U.S. election are all supportive of further significant price appreciation,” the analysts said.

Lawrie Williams, precious metals commentator with bullion dealer Sharps Pixley, wrote in September that he was bullish for the longer term gold price outlook, adding that he believed that share markets were overvalued.

Expectations for a continuing climate of low interest rates, combined with monetary stimulus from central banks, augur for underlying strength in gold prices.

Gold bears no yield, and thus benefits in competition against other assets when interest rates are rock bottom as they are now.

Meanwhile, the outlook for the pound remains weak against the dollar due to uncertainty over Brexit amid strained trade talks between the UK and EU, and due to fears of further social restrictions due to COVID-19.

The pound had its worst week in six months in the second week of September, as investors grew more pessimistic about the chances of a Brexit deal being reached before the December 2020 deadline.

Economic concerns weighed on the pound after data on September 15 showed that the UK’s joblessness rate rose for the first time since the coronavirus lockdown began in March.

If expectations of a quickening U.S. economic recovery take root, the dollar could strengthen further against the pound, increasing returns in sterling terms for UK-based gold savers.